Bitcoin is cool but mostly useless

Sometime around 2010, a furry on a minecraft server sent me my first bitcoin.

I was volunteering as an admin on the server, and we asked for donations to cover server costs. A player with an anthro animal avatar on steam wanted to support us by sending us bitcoin he had mined, and sent me a wallet private key or seed phrase with the amount. I stored it on a text file on my computer.

It was only a few dollars in 2010, but today it would be worth over $100k. I don't think we even cashed it out at the time since it was hard to exchange BTC for USD.

I checked every desktop computer in my possession, every hard drive, every usb drive, nothing. I looked and looked, but eventually concluded it was gone after wiping a hard drive a long time ago.

Now, I have some bitcoin as part of my "speculative investments." I've bought and sold amounts over the past 5 years and have made and lost money. But overall gained.

I want to explain why I think that bitcoin is severely overvalued and a lot of chumps are going to lose money. I'm not using technical analysis, I'm not a financial advisor, so feel free to tell me what I'm missing after you read through the whole thing.

Why I Don't Put My Savings in Bitcoin

I don't invest even close to 5%+ of my income into bitcoin because it's too risky. This isn't a hot take.

Hack, Vulnerabilities, and Software Complexity

Simply put, I don't trust computers.

I am definitely a "computer person". If you put me in a room with a x86 dell laptop, a debian stable live usb drive, and an internet connection, I can stand up a secure web application from scratch. I could make this laptop be a radio station, be a simple NAS, or have it orchestrate IoT devices. Computers are my career.

But software is complex. No single person can ever understand how an operating system works. This means that there is space for vulnerabilities.

The XZ Utils backdoor is a good example of this. A malicious actor was able to contribute to an operating system's code, adding malicious code that enabled attackers to easily hack into to otherwise-secure machines. This was caught and remediated, but there could be thousands of other backdoors, maliciously added or simply discovered.

Even if the blockchain itself could not be hacked, the ecoystem could. Vulnerabilities like this could be present in the systems used to manage bitcoin, from individual holders to Coinbase to the miners themselves. VPNs used to get into the networks that manage bitcoin miners, Tails, Tor, wallets, even computer firmware.

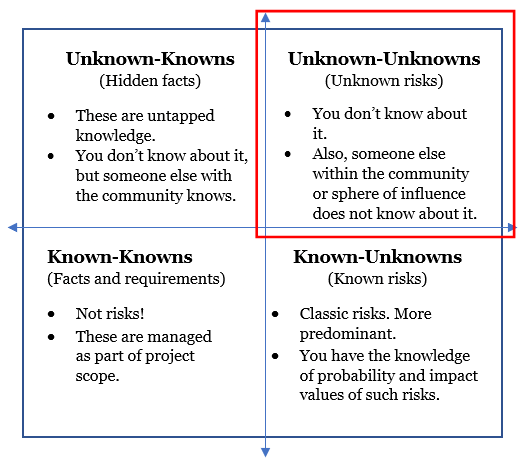

And that's just what we know.

How many Unknown-Unknowns does gold have? Real estate?

Humans have needed a roof over their head for longer than history exists, and we know a lot of ways our shelters can get damaged or lose value. And today, there are thousands of actuaries calculating risk for buildings.

Bitcoin is less than 20 years old. I just can't trust that.

Many People Buy Bitcoin Based on Faith and Emotion

If you take a look at the kind of people posting online about putting money into bitcoin, they use words like "feels like," "I believe," "IT'S NOW OR NEVER!,"...

🇺🇸 President Trump’s son says #Bitcoin is going to $1 MILLION 🚀

— Vivek⚡️ (@Vivek4real_) January 16, 2025

NEXT 4 YEARS ARE GOING TO BE WILD 🤯 pic.twitter.com/dJAH0TDKiz

Indistinguishable from a megachurch

When I see people using this emotional language, it's like they are building a tower of hope up and up and into the clouds, convincing themselves of the value of Bitcoin and projecting this to others.

What is their incentive to do this? Wouldn't they want to keep others in the dark so they can uniquely reap the rewards?

It has no utility for average people

US Dollars can be exchanged for goods and services easily. I can go to a flea market and buy a used air compressor for a $50 bill. No computers are involved, and they can take that $50 and spend it on almost anything.

Gold derives some value (I've seen 10%) from industrial usage, but most of the value is because it's shiny and historically people have wanted it. But that's still a leg over bitcoin. I gave my partner a gold necklace, and she beamed. Holding it in her hands, she smiled when she looked at it, feeling its weight. Can you do that with bitcoin?

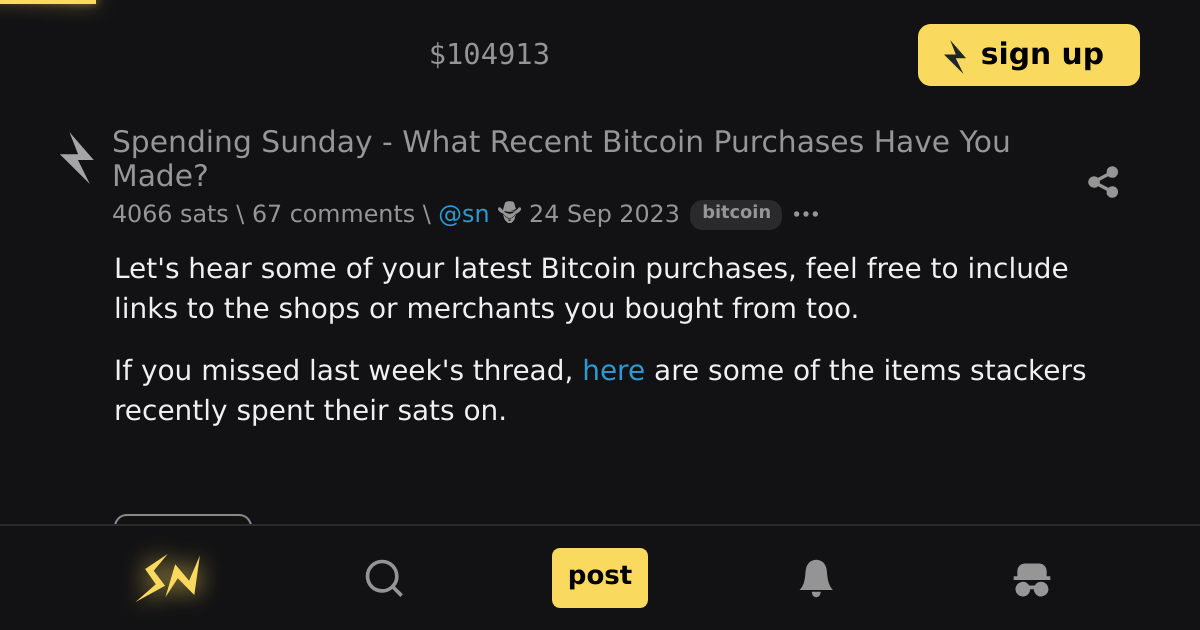

As for bitcoin, let's look at a 2023 thread on stacker.news for examples. Stacker News is a pro-bitcoin forum.

Example responses, sorted from most popular to least:

- paid for search: https://kagi.com/

- VPN (ProtonMail.com), and psilocybin mushroom spores (FungusHead.com)

- a red coldcard about a month ago

- This morning, a pack of beers from local grocery

- Egg sandwich for breakfast at a deli

- Bought myself and my wife some merch to wear out in the wilderness 😹

- This is self-promotional btw

- I topped up my Mullvad vpn using lightning a few days ago, bought 3 months worth.

- Foreign TV subscription for 6 months :-)

- Lightning Channels; Hashrate from reactor.xyz

- child comment says "sir, that is like paying yourself 😂😂😂😂"

- I just ordered a gang of shirts from the Lightning Store and Dr. Orange Pill

- Gas and grocery gift cards.

Nearly every single thing on this list is easier to buy with a credit card or cash. It's usually more expensive to use bitcoin due to payment processing fees, unless they set it up themselves.

Mullvad, a VPN service, is crypto-friendly and it's a good place to spend bitcoin. But you can also mail them cash, or use any other cryptocurrency. They even offer a discount on bitcoin, but also other cryptocurrencies. Annas archive is similar.

Anonymous Payments

What's unsaid with crypto is the "untraceable currency" aspect, and in my opinion this is where some true value is. There are some examples above like buying psilocybin spores, or online services you don't want linked to your identity. And other stacker.news threads mention this as people's first purchase with bitcoin.

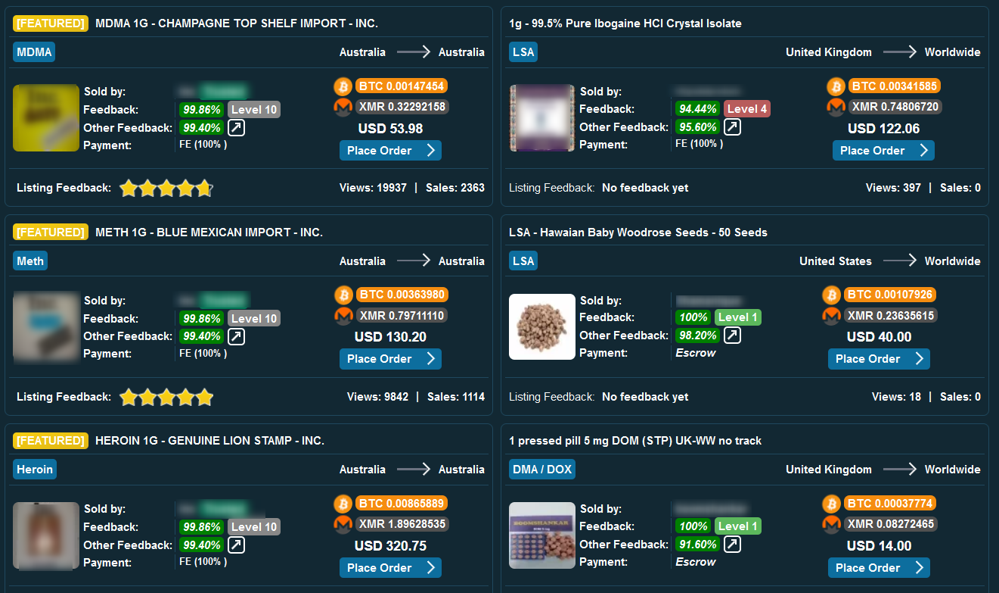

Buying drugs online is likely where a lot of the early adopters started making actual transactions with bitcoin.

Someone selling 99.5% Pure Ibogaine HCI Crystal Isolate couldn't just take credit card, it would deanonymize both buyers and sellers, and transactions could be disputed. Same with buying private servers or not linking your identity to VPN providers. Sending cash through the mail isn't feasible for similar reasons. So Bitcoin solves a real problem here.

The problem with this is that bitcoin isn't anonymous. It's so much more traceable than cash.

If you buy bitcoin from Coinbase or any legal exchange in US, you need to give them your SSN and a scan of your drivers license.

There are ways to get around this, but you are betting that your methods are smarter than the power of the government both now and into the future. They have invested millions of dollars into tracing bitcoin usage.

There is a good solution for criminals: Use Monero. This is a different cryptocurrency that uses a ring signatures, zero-knowledge proofs, and other fancy methods to make it completely anonymous by design.

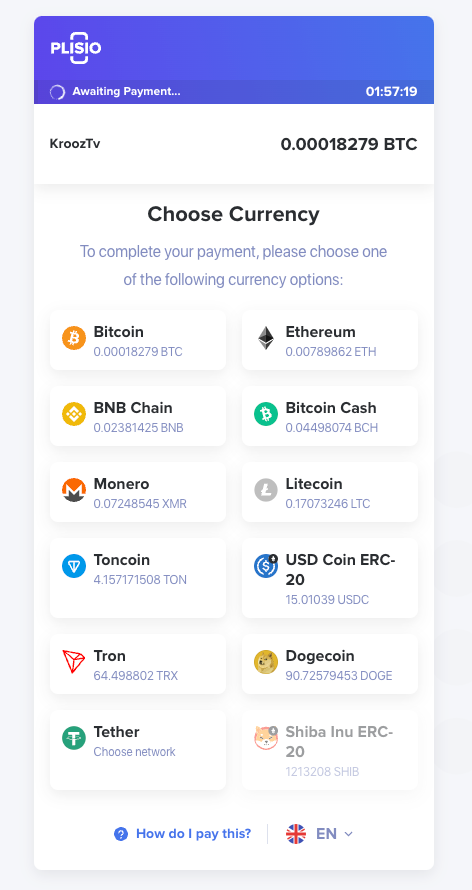

Years ago, bitcoin was the primary way to make anonymous transactions online, but over time both buyers and sellers started using Monero more and more. You can even look at the screenshot of the darknet market I posted above – Prices are quoted in both BTC and Monero (XMR). For someone choosing between the two, trying to transact anonymously, Monero is safer.

Looking beyond drug markets, for buying legal yet sensitive things like psilocybin spores or VPNs, they are starting to accept Monero more and more.

You could go from bitcoin to Monero and back to Bitcoin, but as this market moves towards using Monero for transactions I don't why people would go through that trouble.

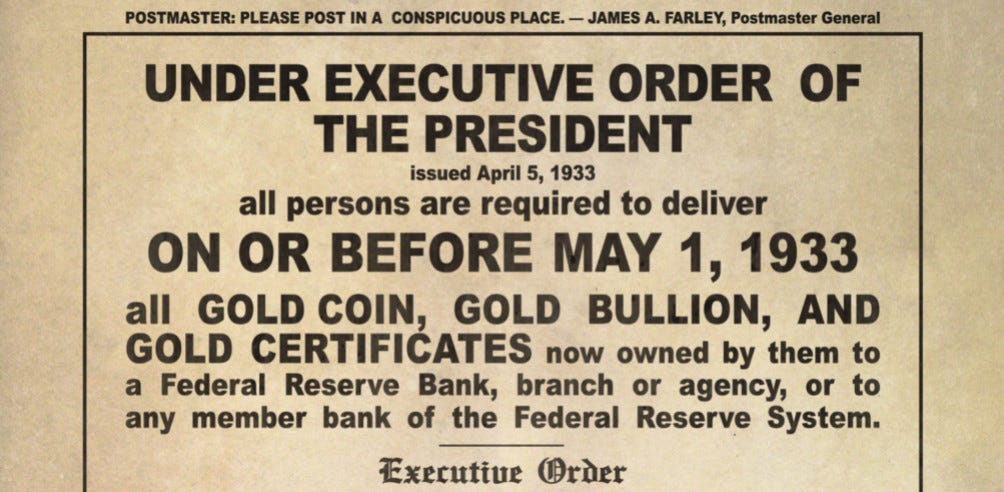

The Government

The government will find a way to win. Even if Crypto King Trump supports it for this cycle, it would just take a few years of political change to bring that value down.

Imagine an energy crisis, and the US or other countries made crypto mining illegal. Legislation is introduced which makes transactions in certain "high-energy-usage" cryptocurrency illegal or heavily regulated.

The majority of crypto holders have their crypto held by a third-party like Coinbase or Kraken, and the government could force Coinbase to prevent transactions from these wallets.

Monero or other privacy-focused cryptocurrencies are safer from dynamics like this since every movement of currency is untraceable. Bitcoin is more vulnerable since the state has developed expertise at tracking it, and many holders are operating entirely within controlled crypto payment rails.

Nation-state Money Launderers Want to Get Rid of Bitcoin

Bitcoin or other cryptocurrency is valuable to bad actors because it allows them to easily transfer money around the world, semi-anonymously.

But this is a means to an end. From this article, quoting Ari Redbord, global head of policy at blockchain analytics firm TRM Labs:

To the best of our knowledge, North Korea has never used crypto to pay for things on the international scene. Instead, it tries to convert the tokens into government-issued currencies like the Chinese renminbi or the U.S. dollar, Redbord said.

[...]

“You're inevitably seeing these funds sit in wallets over long periods of time. I don't think that's them setting up a strategic reserve of some kind; they’re just not being able to off-ramp the funds,” Redbord said. “In every world, North Korea wants to get those funds off-chain as fast as they can.”

People want to hold onto equities like Apple, or stash physical gold, and assume it will grow in value. Other countries buy Treasuries/USD as a safety net, assuming it will remain useful and valuable. But if we are trusting Ari's prognosis, some of the largest holders of this currency are trying to get rid of it.

We could then imagine a world where the froth of these big funds are being used to pay people to create videos or push media about purchasing bitcoins, hopefully allowing enough liquidity to offload this money.

This is entirely unfounded conspiratorial thinking on my part – but if I was in a position where I needed to offload BTC to USD, I would want to find a way to get other people to convert USD>BTC so I could do the opposite trade of BTC>USD or BTC>RMB.

Why I Still Buy and Hold Bitcoin

Because I could be wrong! And it has some utility.

For the same reason I think it's insane for someone to put 50% of their wealth in a speculative asset like bitcoin, I think it's crazy not to put a little of your money into it, just in case.

I think bitcoin is severely overvalued, but still has utility. It is the "currency of the internet" and has the most widespread popularity of any crypto asset.

If I had to make a semi-anonymous transaction with someone in Argentina, using bitcoin with escrow is probably one of the better ways to do it. Bitcoin has relatively mature "rails" for intercontinental capital flows.

As a store of value, it is extremely safe – if you know what you are doing. Generate a wallet, write down the seed phrase on paper, memorize it over a month, burn it, and you are the only one with access to money. You can incorporate hot and cold hardware wallets for better security.

The bitcoin I held since 2015 has gone up tremendously in value, and I consider myself lucky to have ridden the wave of a speculative asset. I sold a lot of it recently, but I'm still holding onto enough to benefit from possible increases in value.

My view is summed up by a quote from Lyn Alden, an investment strategist bullish on bitcoin who I trust more than I will trust my own opinions on this. Emphasis mine:

At the current time, I view Bitcoin as an asymmetric bet for a small part of a diversified portfolio, based on a) Bitcoin’s demonstrated network effect and security, b) where we are in Bitcoin’s programmed halving cycle, and c) the unusual macro backdrop that favors Bitcoin as a potential hedge.

If a few percentage points of a portfolio are allocated to it, there is a limited risk of loss. If Bitcoin’s price gets cut in half or somehow loses its value entirely over the next two years, and this fourth cycle fails to launch and totally breaks down and completely diverges from the three previous launch/halving cycles, then the bet for this period will have been a dud. On the other hand, it’s not out of the question for Bitcoin to triple, quadruple, or have a potential moonshot price action from current levels over that period if it plays out anything remotely like the previous three launch/halving cycles

What will happen in this cycle? I don’t know. But the more I study the way the protocol works, and by observing the ecosystem around it over the years, I am increasingly bullish on it as a calculated speculation with a two-year viewpoint for now, and potentially for much longer than that.

Final Thoughts

Bitcoin is cool, it's a useful tool, but I don't trust it as a personal storage of value or investment.

Some actual professional investors think it's worth it, but I want to keep my stake in this low.

It mostly comes down to "I don't trust software" to "too many chumps are buying it," that I don't know how people are actually using it beyond illegal activities or a speculative store of value.

Nostr, stackernews, and other places that the average person interacts with the blockchain are neat, but I'm not convinced that bitcoin is the only cryptocurrency that can be used there.

Animal spirits or future changes in economies may change this outlook, but even viewing bitcoin as a tool to transact currency, there are other cryptocurriencies that can fulfill the same purpose with less transaction fees, programatic anonymity, or robust smart contract capabilities.